Key Points

- Sound Money is a concept predating the internet that inspired the invention of Bitcoin and blockchain technology.

- Money can be considered sound if it has several quantifiable properties, and these properties are encoded into ETC.

- One important property is scarcity, which ETC gets from its fixed emission curve leading to a known future supply.

- If a project does not have a known future supply, maintainers can arbitrarily inflate the value of a currency away from holders.

- This risk remains present on all chains that do not have a fixed emissions curve, including Ethereum™.

Introduction

The backbone of strong economies, the provider of stability, the incentiviser of healthy time preference, the creator of prosperity. Sound money is the antidote to many of the problems created by the financial abuses of centralization in the wider world, and is the core concept that spurred the creation of Bitcoin.

From the Austrian School of Economics many of the theories behind Bitcoin, including Sound Money, saw their philosophical gestation. Decades before Bitcoin was technologically conceivable, economists such as Ludwig von Mises, Fredreick Hayek and Milton Friedman were professing the dangers of fiat money and the advantage of systems of finance that are free from manipulation by central authorities.

Properties of Sound Money

Money is the lifeblood that transports energy and information around an economy, which is why well-designed currency is critical for a functional society. It was identified that money must serve three purposes: as a unit of account, a store of value, and a medium of exchange. These three functions are facilitated by several properties, which were intentionally engineered into the design of Bitcoin and inherited by ETC:

- Divisibility: ETC is divisible up to 18 decimal places. This means that ETC can be split into 1,000,000,000,000,000,000 smaller units if needed. Denominations of ETC can be written in

wei, the smallest ETC unit currently available. - Transferability: Since ETC isn’t tied to any banks or governments, it’s easily transferable across countries and between users on a global scale. This gives ETC an advantage over paper money and precious metals, which aren't as easily transferable across long distances.

- Fungibility: Each ETC is worth precisely what it’s valued at on the market. One ETC won’t have different values based on previous ETC transactions—unlike some currencies where older bills are often worth less than newer ones. This is called fungibility, and it’s a property ETC shares with physical commodities like gold and silver.

- Durability: ETC is incredibly durable. It is ultimately just information, so it can be stored on a computer or in a digital wallet, or even offline on a piece of paper or metal. This makes ETC much more durable than traditional forms of money like paper currency which can be easily destroyed or lost.

- Portability: ETC is highly portable. You can carry it on a thumb drive, phone, write it down on paper, or remember it as a seed phrase.

- Scarcity: ETC has a finite supply that will be released over time. This makes it scarcer than most other forms of currency.

Known Future Supply

ETC has all the properties of Sound Money. It’s decentralized, uncensorable, divisible, transferable, fungible, durable and scarce. The cornerstone of a blockchain's sound monetary policy is scarcity via a known future supply. Just like Bitcoin, but unlike Ethereum™, Classic has a fixed emission curve. A fixed amount of ETC created as a block reward for miners, which means that holders of ETC can accurately calculate the total amount of ETC in existence at any point in time.

Ethereum Classic's fixed emission curve was introduced by ECIP-1017. The emission schedule, also known as 5M20, reduces the block reward by 20% every 5,000,000 blocks. Socially, this block reward reduction event has taken the moniker of "The Fifthening."

| Est. Date | 5M20 Era | Block | Block Reward | Total Era Emission |

|---|---|---|---|---|

| 2015-07-30 | Era 1 | 1 | 5 ETC | 25,000,000 ETC |

| 2017-12-11 | Era 2 | 5,000,001 | 4 ETC | 20,000,000 ETC |

| 2020-03-17 | Era 3 | 10,000,001 | 3.2 ETC | 16,000,000 ETC |

| 2022-04-15 | Era 4 | 15,000,001 | 2.56 ETC | 12,800,000 ETC |

| 2024-05-07 | Era 5 | 20,000,001 | 2.048 ETC | 10,240,000 ETC |

| ~Every 2 Years | N+1 | N+5,000,000 | -20% | Total ~200,000,000 ETC |

Note: due to fluctuating uncle rate, the exact emission amount will deviate slightly, but not significantly.

A fixed emissions curve means that the rate of inflation is predictable, and in the case of ETC, is continually decreasing over time. As the value of the network increases, the value of all ETC increases predictably according to this rate, rather than some unknown future rate that could be much lower. ETC's commitment to a fixed emission curve is enshrined into both the protocol and its social layer, and thanks to Proof of Work, any hard fork that attempts to manipulate inflation will result in a permanent chain split, massively disincentivizing such a change to the point of it being extremely unlikely to be contemplated, let alone be attempted, let alone be successful.

A known future supply not only provides a prosperous alternative to the legacy fiat system, but also a critical sociotechnological role in the blockchains that utilize it as the basis for keeping a project decentralized. The monetary policy of a blockchain is a common agreement that all participants voluntarily engage with. It keeps all parties aligned economically and helps prevent groups from accumulating unfair influence over others. This unwavering neutrality is what keeps all participants on an equal footing.

Sound money, and it's ability to hold value over time, is a core property of the incentivization mechanisms that encourage participation, as while it does not guarantee that an asset will appreciate, it at least provides a means to calculate future earnings potential given the future growth of a project. It means that holders are guaranteed to benefit fairly from a project's upside.

Unsound Money

Be it fiat or cryptocurrencies, redistribution of funds via inflation or currency debasement is one of the oldest tricks in the book for meddling central planners with a misplaced sense of authority. In times of trouble, they inevitably use this mechanism to ensure that when the ship goes down, those who control the keys to the castle will be the first on the life rafts, as they can redistribute whatever dregs of value remain to themselves at the expense of holders of the currency, all in the name of safety and stability, of course.

This failure state is a type of rugpull that can only exist in projects that are not sufficiently decentralized. The redistribution of value away from holders to some specific group (be it miners, stakers, or developers) can only happen when the balance of power is uneven, such that some participants can push through changes to the protocol that put their interests before others.

The alternative to a known future supply is an unknown future supply, leading to an unbounded degree of inflation or currency debasement down the road. In small amounts inflation may be unnoticeable and be drowned out by the day to day volatility of markets, but it nevertheless amounts to a tax on holders of the currency that do not enjoy the immediate benefits of the Cantillon Effect.

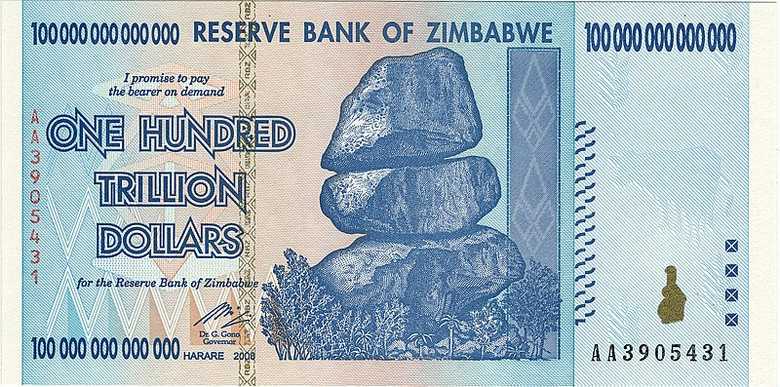

In extreme cases, chains with a policy of maintaining an unknown future supply can lead to Zimbabwe-like hyperinflation, which is an ever-present dark cloud that hangs over all holders of these currencies. Although these projects may not need to turn on the inflation tap today, it may become "necessary" for whatever reason in the future. Be it development funding issues or the race to the bottom of competing with other chains' Proof of Stake yields, without the precedent of a fixed emission curve, the central organizing committee of such projects can easily conjure up any number of justifications for appropriating value away from holders as the only way for the project to continue.

Some promoters of cryptocurrencies, perhaps unintentionally, gaslight their fellow holders into believing that the checks and balances provided by fixed future supply are a hindrance, postulating that it is somehow in the financial interests of holders not to have one.

The idea of ultrasound money, a synonym of unsound money, means that the future supply of a currency is unknown, and while maintainers pinky-promise that it will never be higher than it needs to be, that could be anything from zero to infinity. An ultrasound future supply is subject to tinkering based on an undefined and unpredictable criterion, meaning its central authority reserves the unrestricted right to redistribute funds away from holders in the future.

Yeah, your boring old car might be safe, but check out this bad boy over here. We removed the breaks and seat belts, so now it's ultrasafe.

- Advocates of

Ultrasound MoneyUltrasafe Vehicles

Regrettably, in contrast with Ethereum Classic, perhaps to provide optionality in the future for attracting Proof of Stake collateral, Ethereum™ is one of many cryptocurrency projects that maintains a policy of unknown future supply, which in turn means that holders are exposed to the risk of unbounded future inflation.